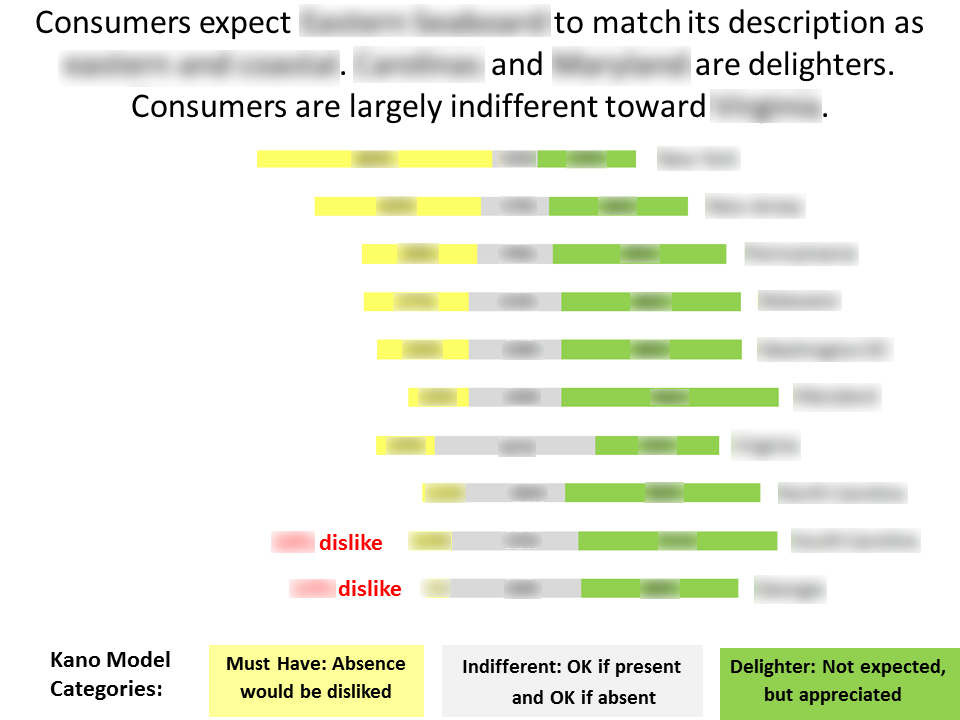

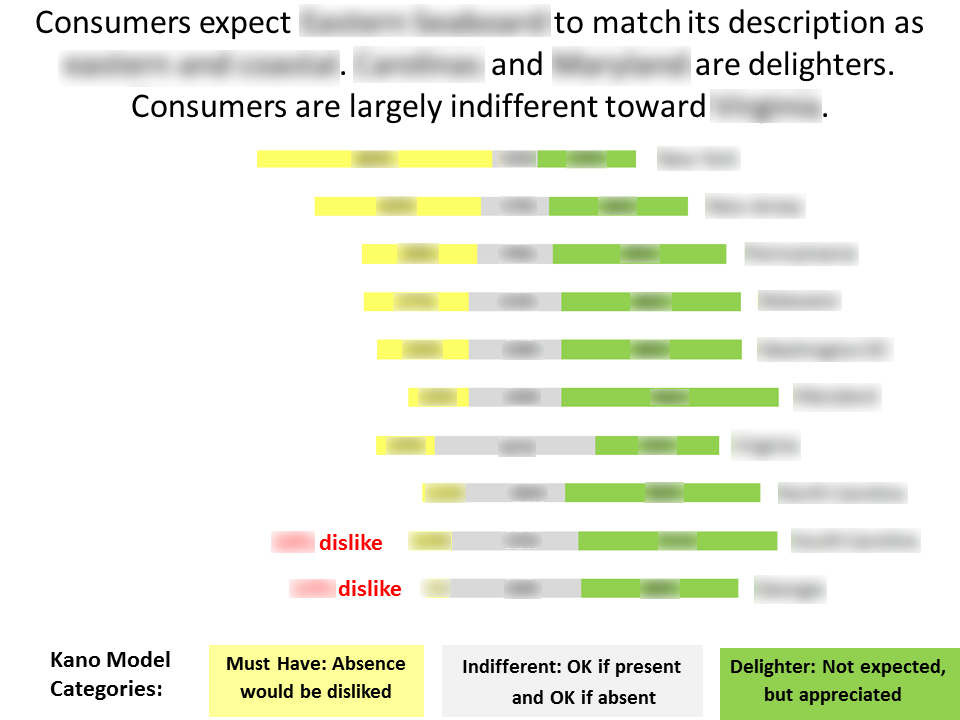

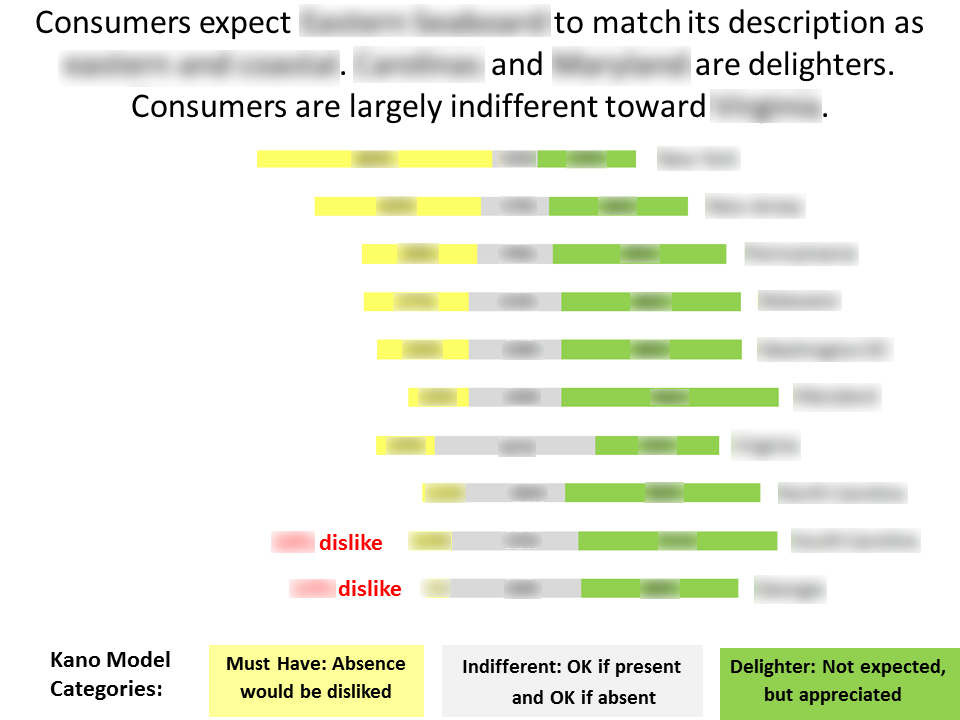

When a major manufacturer of consumer durable goods was planning a new product, it was vital to prioritize the most important features to include. We implemented a Kano model of the options under consideration, ascertaining consumer reactions to each feature's potential presence and potential absence. The result: the client understood the "must have" features that consumers require, as well as the "delighters" that would stand out from the competition.

Click to enlarge

Click to enlarge

Click to enlarge

Click to enlarge

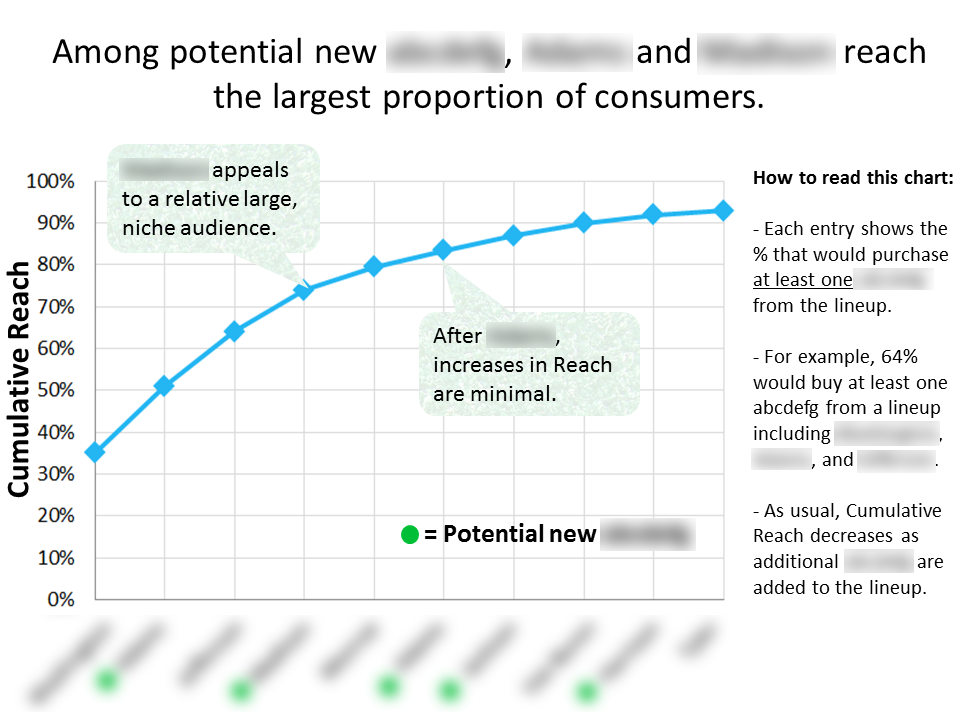

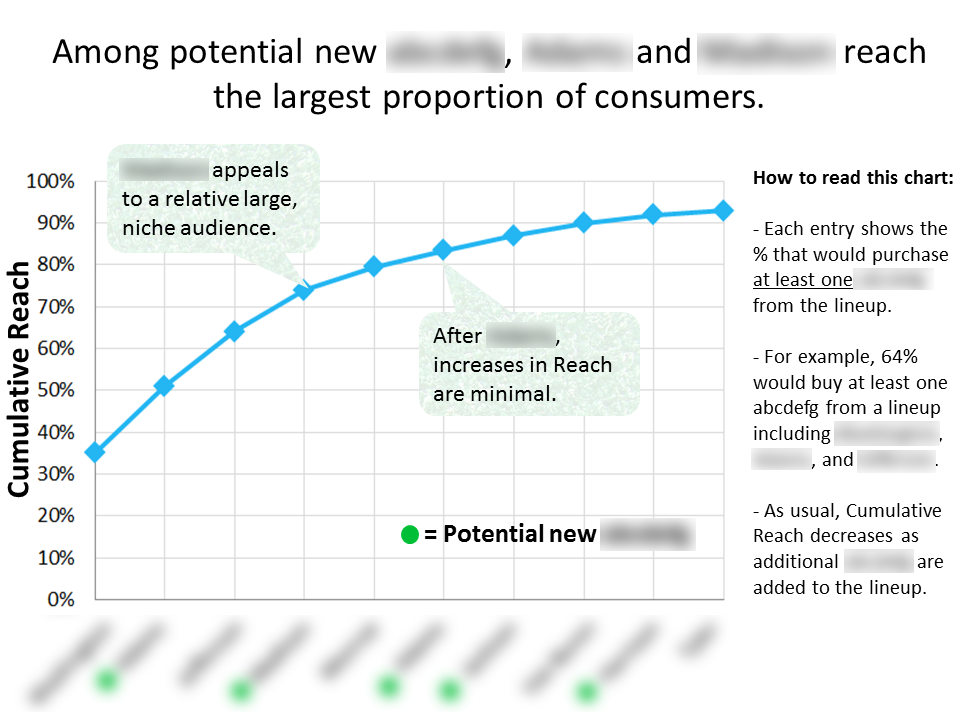

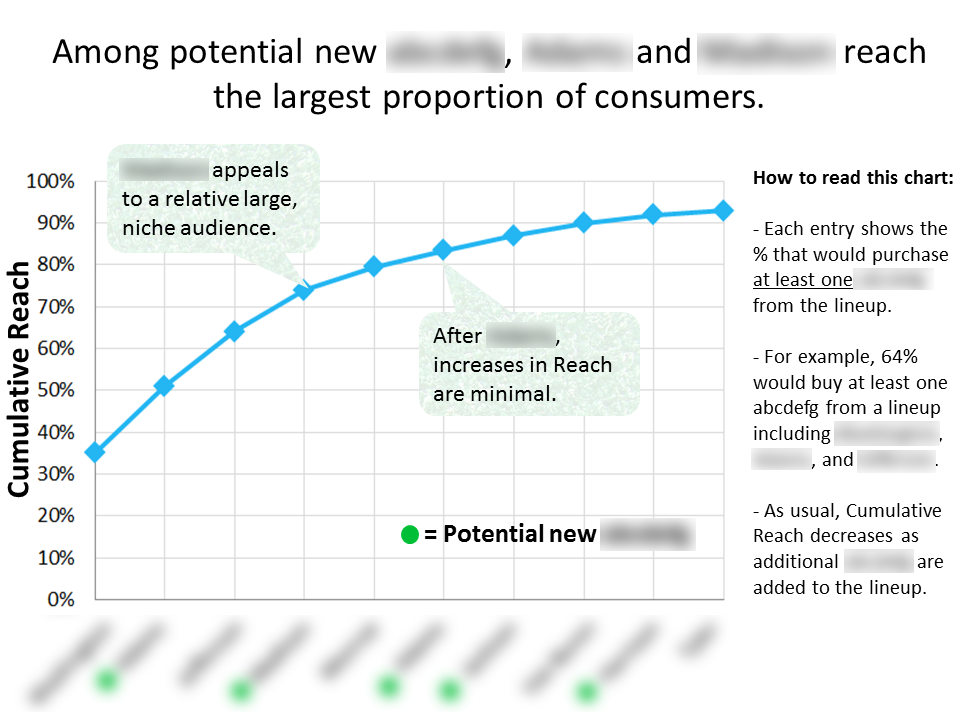

When a Consumer Packaged Goods manufacturer needed to know how some potential new products would impact their existing line, we designed a T.U.R.F. analysis (Total Unduplicated Reach and Frequency) to assess the situation. With the study's results, and a custom-made simulator, the client was able to identify the most promising new products and jettison the least important existing products. And, through benchmarking against existing products, we were able estimate the sales potential of their new offerings.

Click to enlarge

Click to enlarge

Click to enlarge

Click to enlarge

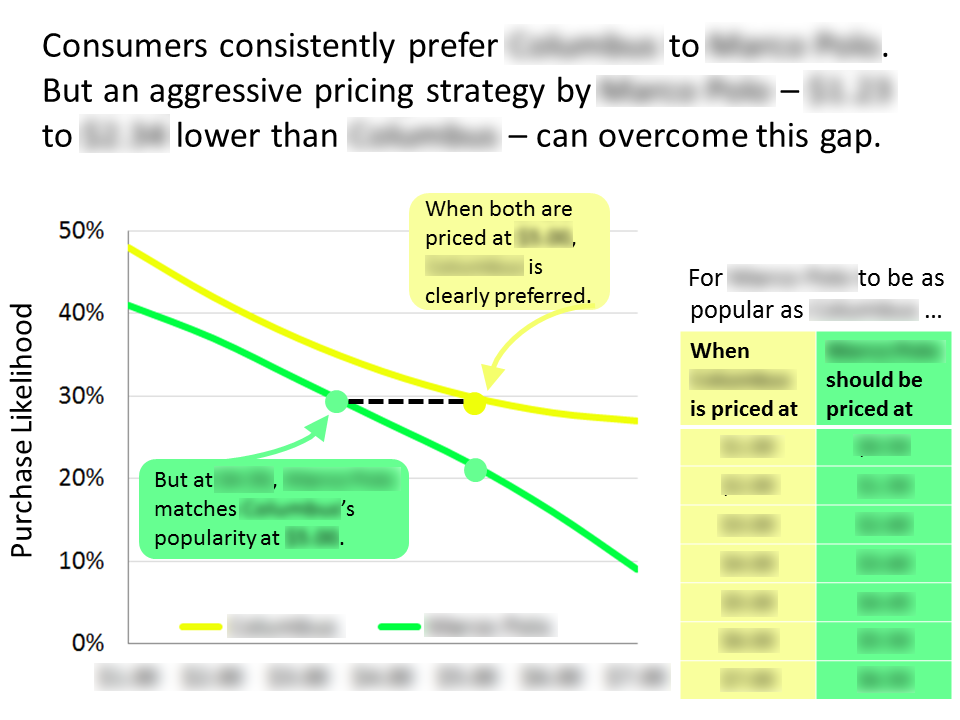

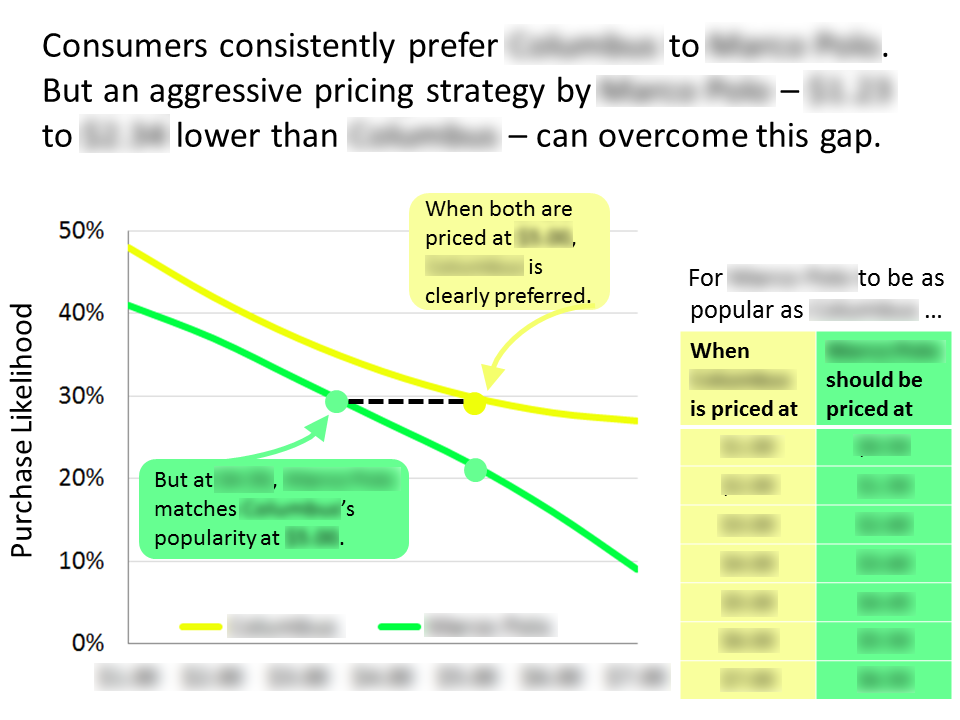

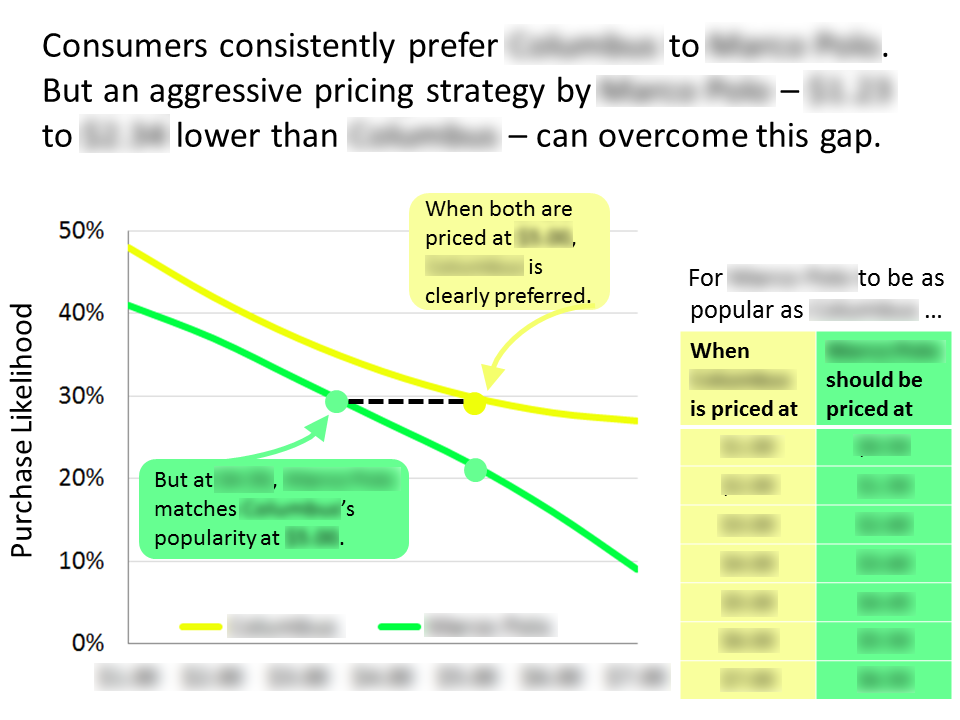

A well-established CPG company with a flagging brand wanted to understand consumer preferences within its category. We crafted a Discrete Choice Model to measure consumer preferences and trade-offs involving brand, price and several other product-relevant attributes. The client learned that their product could prevail if it were priced lower than the competition, and further, that this "price gap" was largest at extreme (high or low) price points.

Click to enlarge

Click to enlarge

Click to enlarge

Click to enlarge

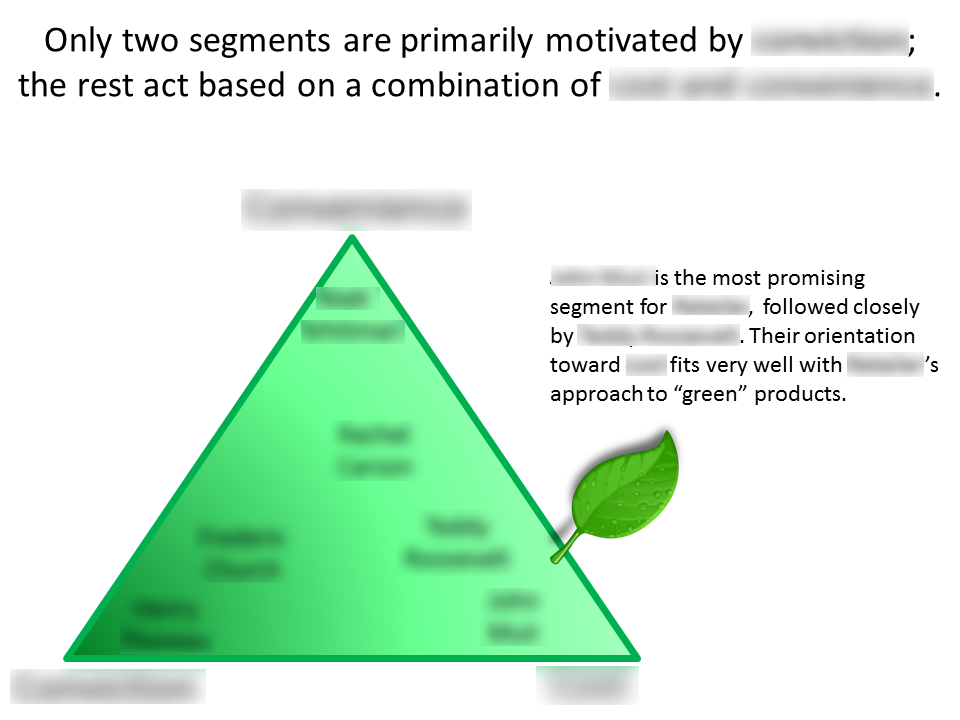

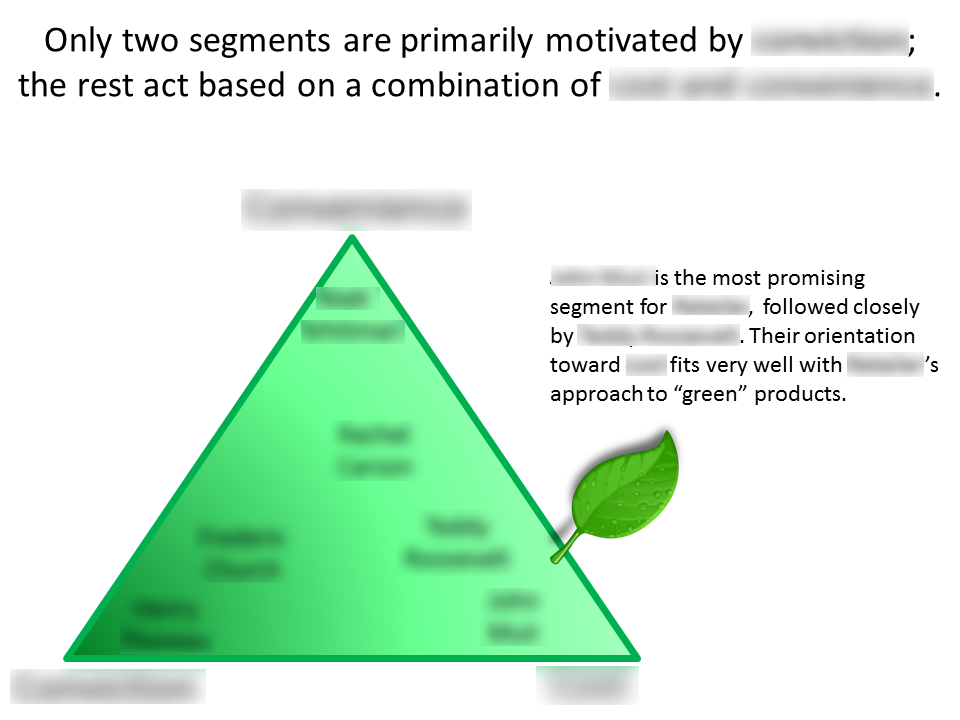

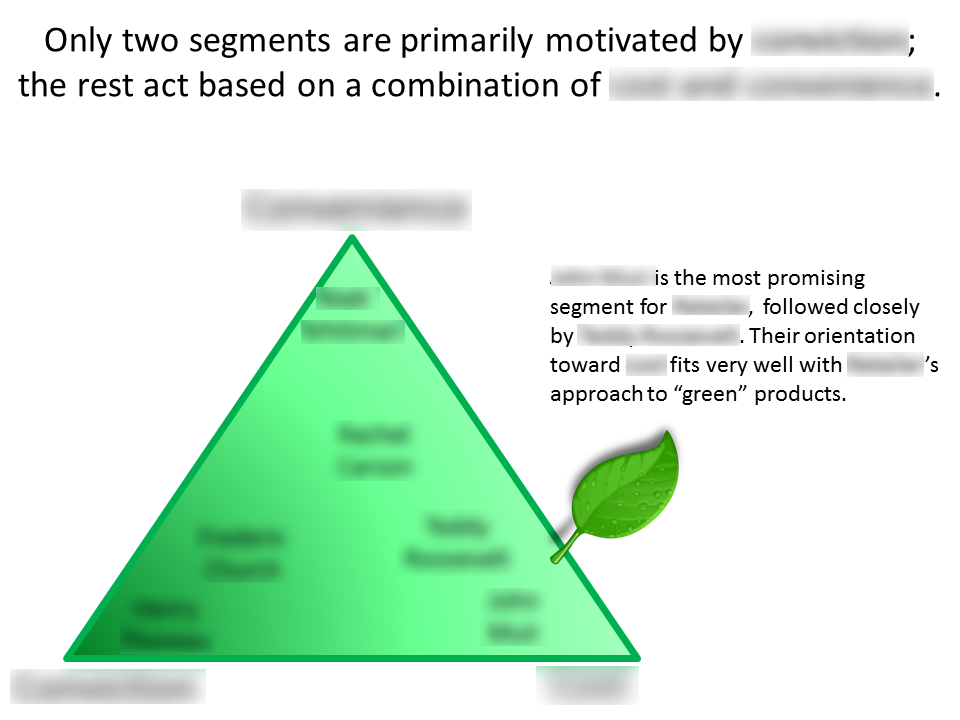

As part of an environmentally-themed initiative, a retailer needed to categorize consumers into "green" segments. We designed a segmentation study based on a battery of questions about attitudes toward the environment, as well as everyday behavior with environmental consequences. The client came to realize that "green" behaviors may be driven by many different factors including attitudes (e.g. conservation), convenience (e.g. recycling), and economics (e.g. carpooling).

Click to enlarge

Click to enlarge

Click to enlarge

Click to enlarge

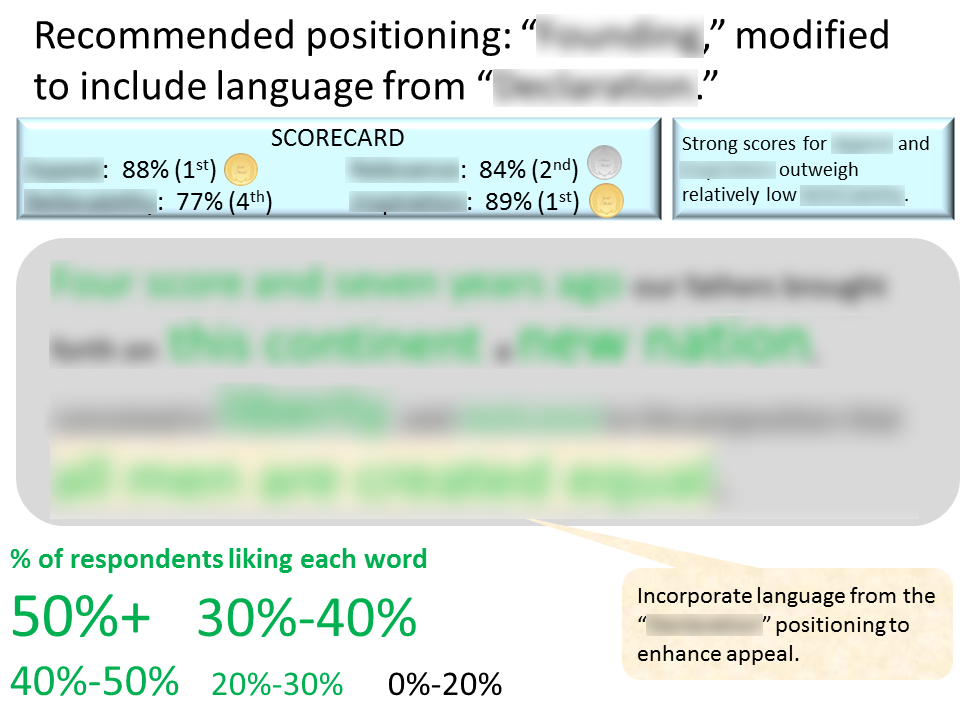

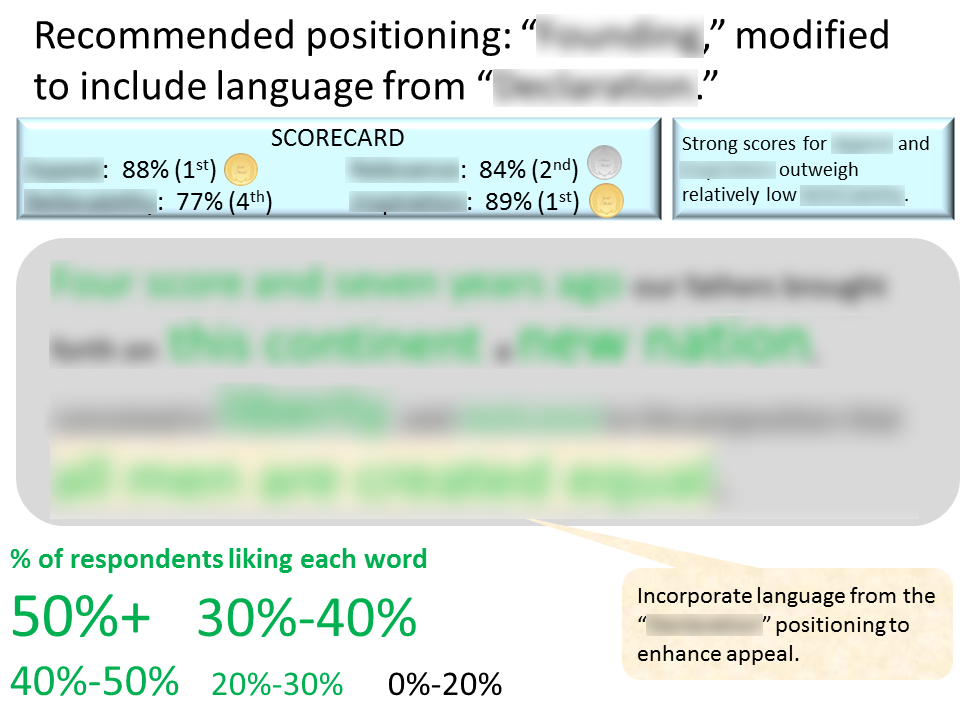

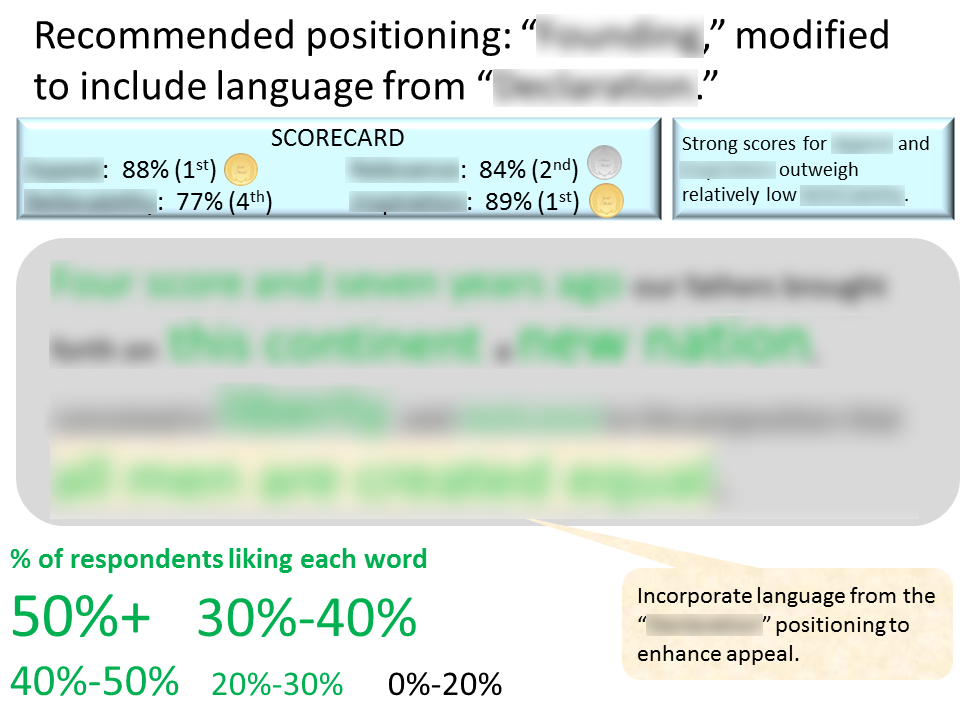

A well-known manufacturer needed to reposition its brand in a changing marketplace. We designed a survey to test consumer reactions to potential brand positions, and to determine the words and phrases that most resonated with consumers. We identified the best-performing position, but also found some popular phraseology in other positions. With this, we were able to recommend a new, revised positioning that combined the best elements of several of those tested.

Click to enlarge

Click to enlarge

Click to enlarge

Click to enlarge

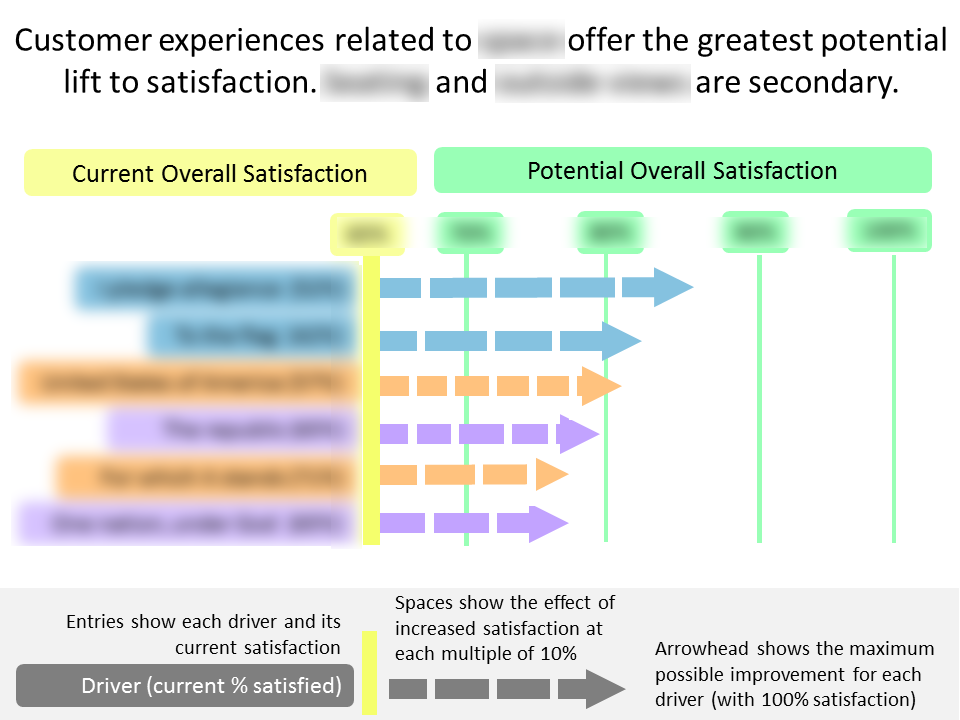

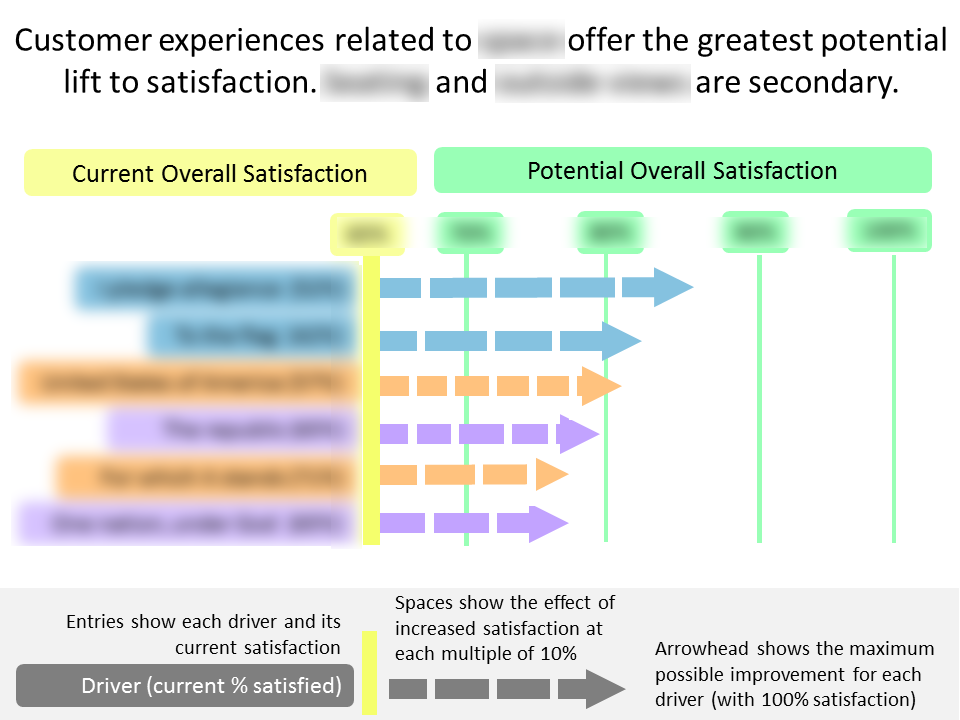

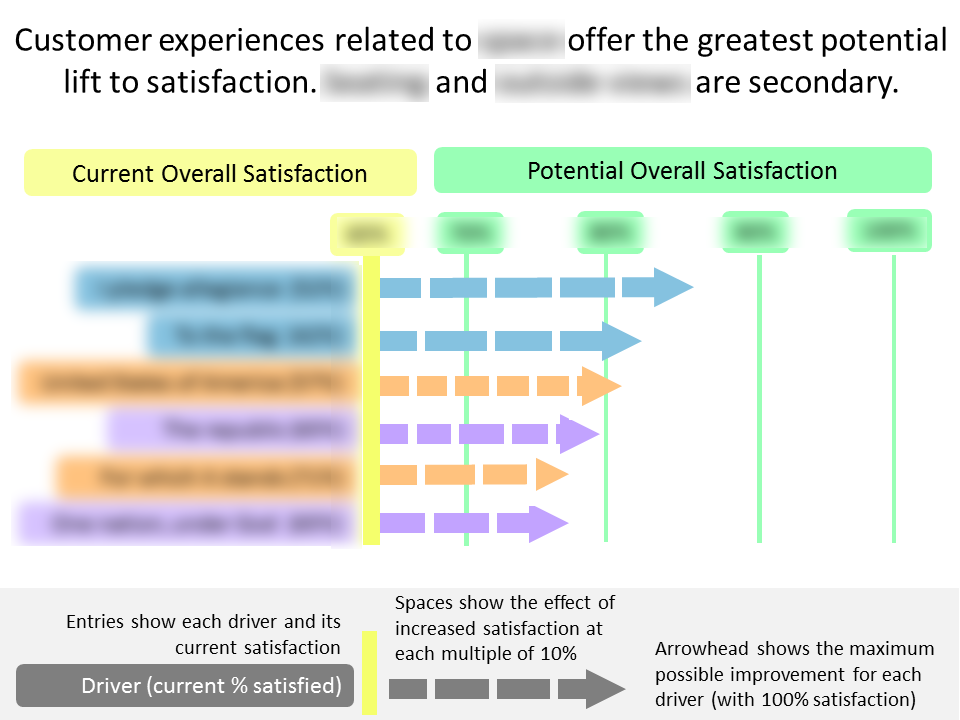

As a prominent manufacturer of durable goods considered its brand health, we recommended research to determine the drivers of brand reputation as measured by the client's preferred metric: Net Promoter Score. Our survey explored in-depth the reasons behind Likelihood to Recommend (or not), and our analysis used tabular and regression-based analysis to identify the key drivers. The results not only answered "how are we doing," but also explained "why?"

Click to enlarge

Click to enlarge

Click to enlarge

Click to enlarge

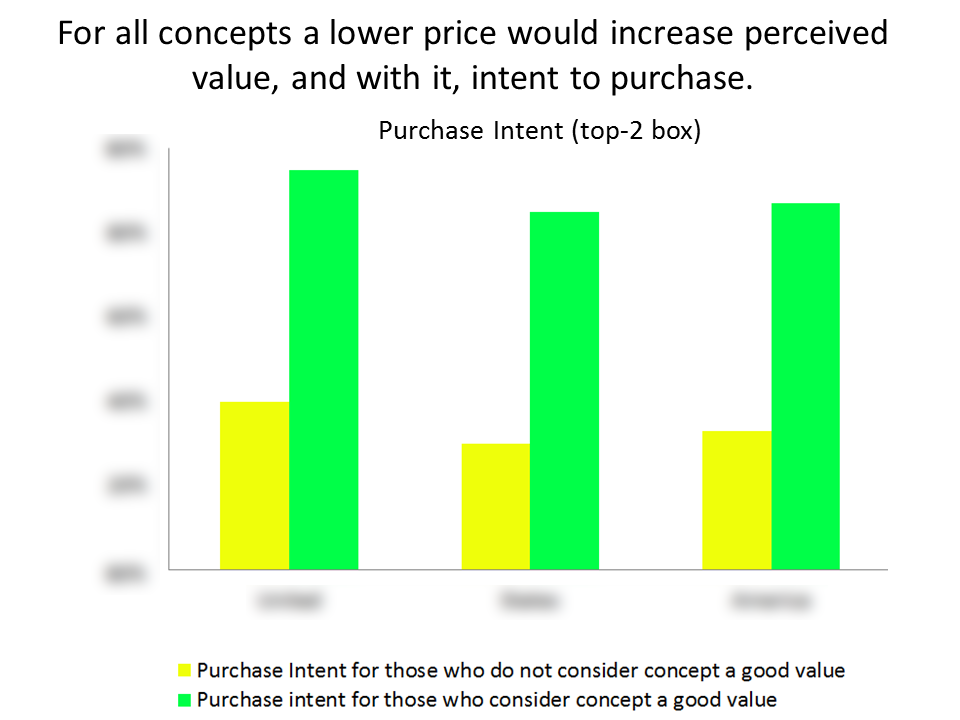

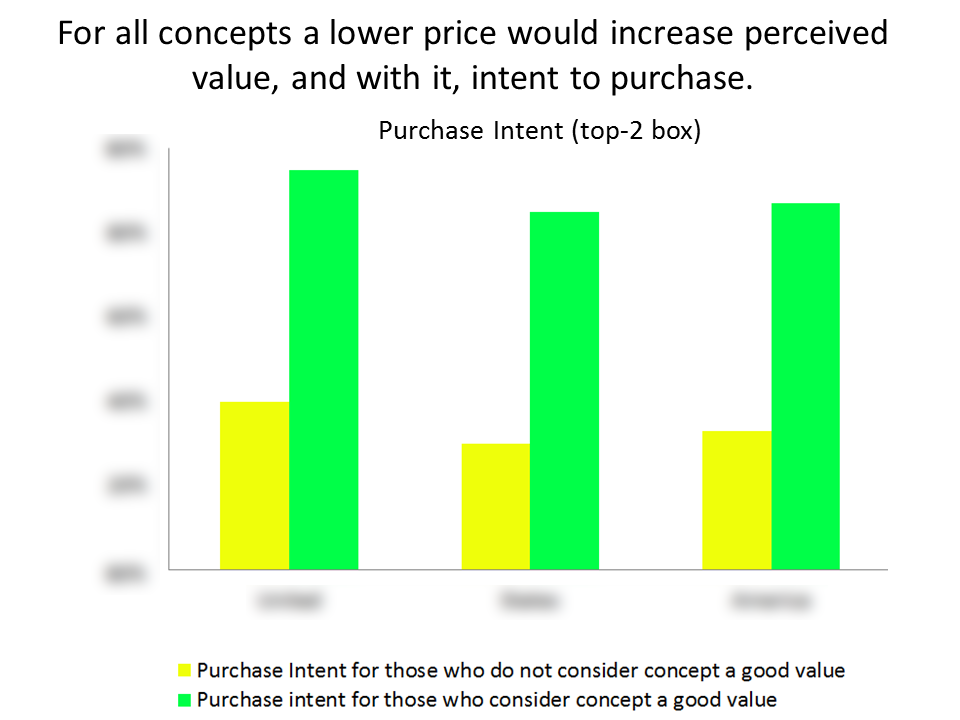

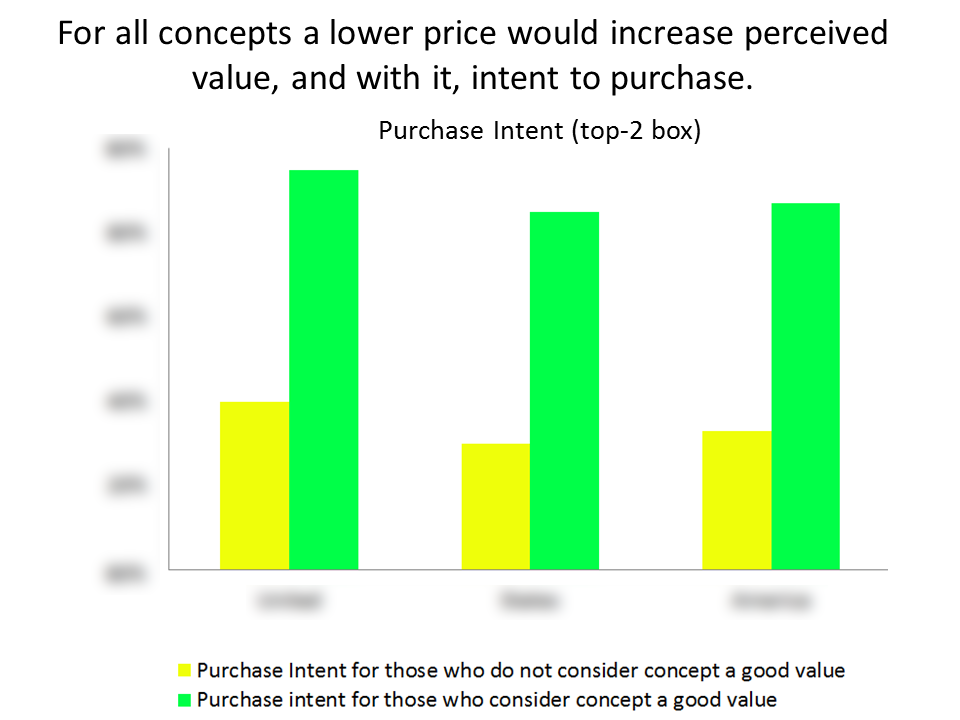

A Consumer Packaged Goods manufacturer needed to know the appeal of a new product, and determine which messaging most resonated with consumers. Our survey asked consumers to evaluate several characteristics of three, different concepts (monadically). The study's findings identified the most promising type of consumer, based on current products purchased. The client also learned, to their surprise, that low perceptions of value hampered product acceptance. Text highlighting results helped tailor messaging for the winning concept.

Click to enlarge

Click to enlarge

Click to enlarge

Click to enlarge